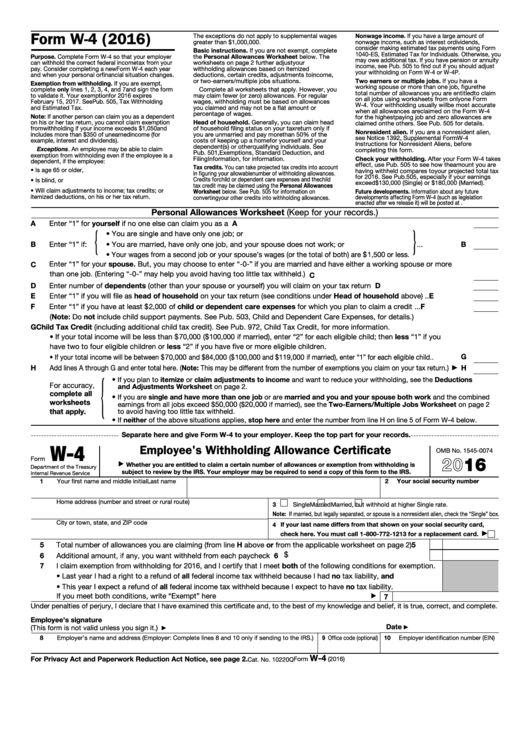

W4 Withholding Form 2025. The state of michigan’s payroll withholding tax rate is 4.25%. However, extending some provisions would ultimately be a positive revenue generator.

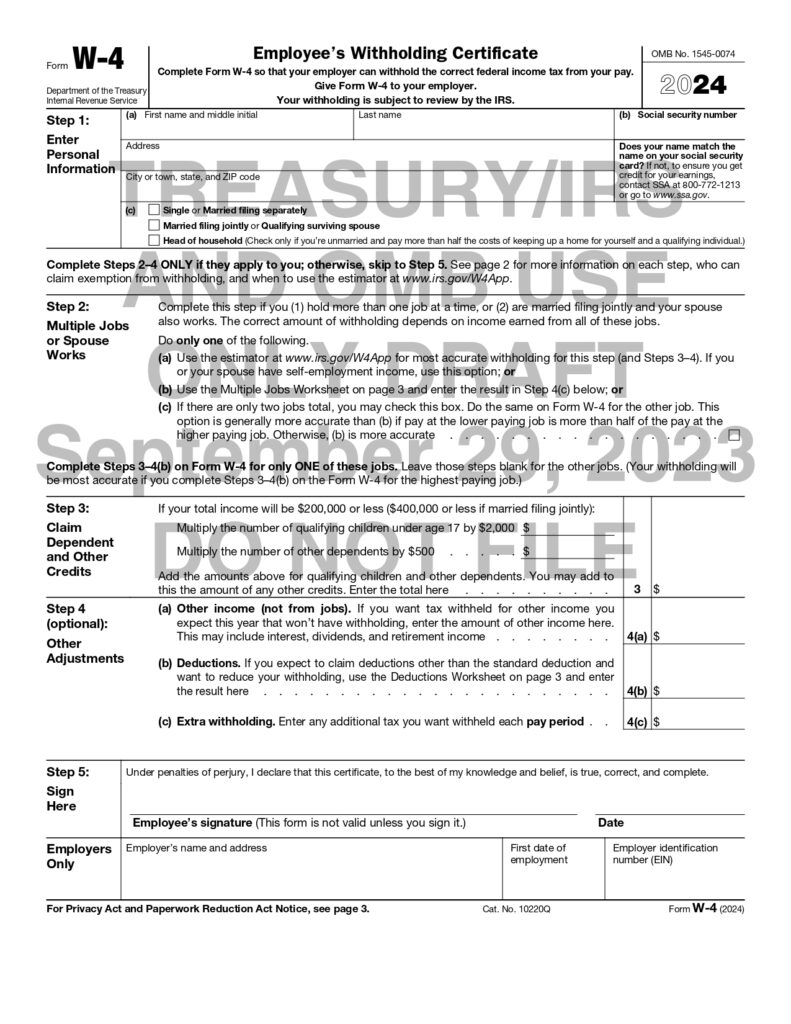

A tip was added that states employees should consider using the irs’s tax. Federal income withholding tax brackets remain at 10, 12, 22, 24, 32, 35, and 37%.

Irs 2025 W4 Form Ava Hudson, A tip was added that states employees should consider using the irs’s tax.

W4 Withholding Form 2025 Calendar Gabey Jocelin, See the different requirements for both employers and employees for 2025.

W4 Form 2025 Pdf Irs Genni Angelia, A tip was added that states employees should consider using the irs’s tax.

Form W4 (Employee's Withholding Certificate) template ONLYOFFICE, We explain the five steps to filling it out and answer other faq about the form.

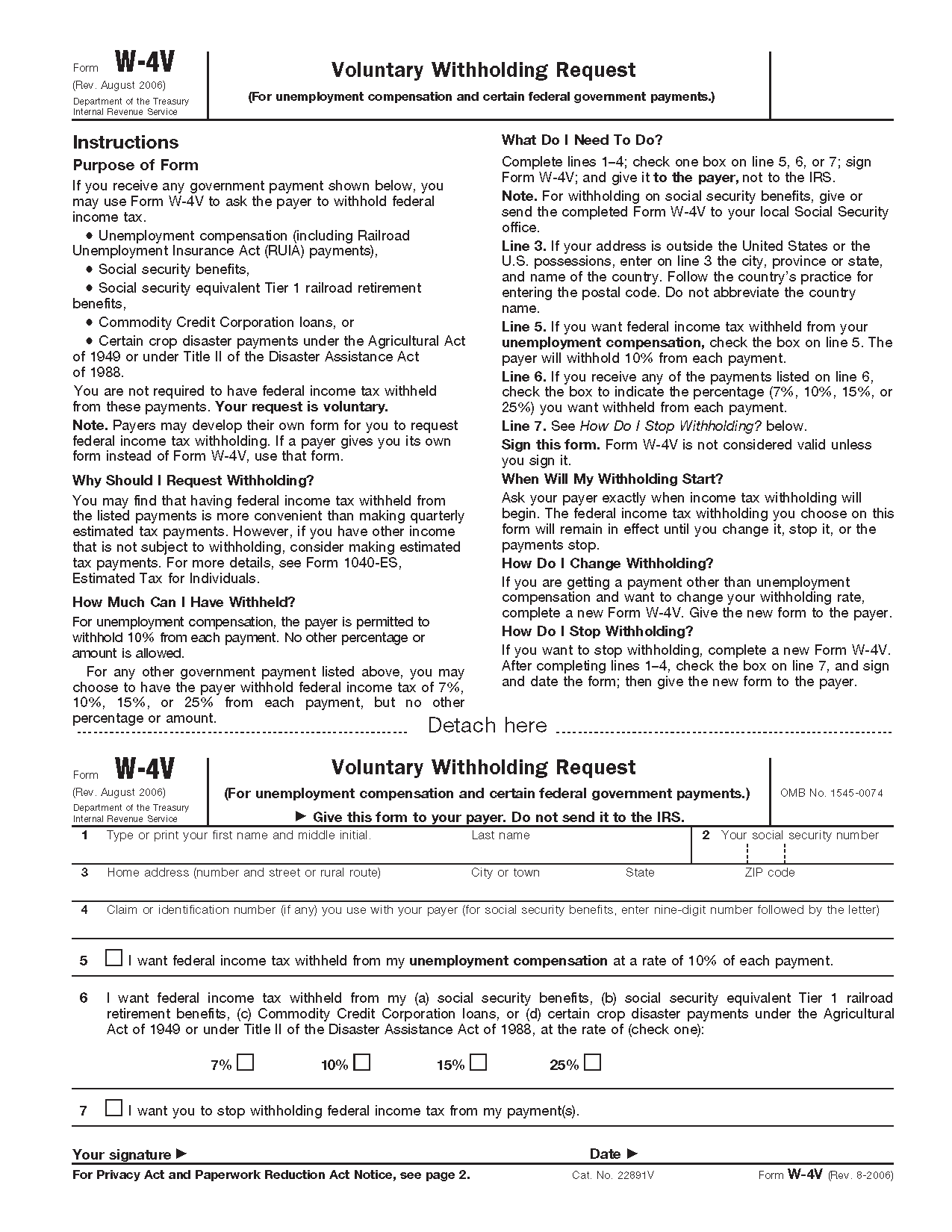

W4 Form 2025 Withholding Adjustment W4 Forms TaxUni, Form mw506r may be filed not less than 60 days after the date the tax withheld is paid to the clerk of the circuit court.

IRS Form W4. Employee's Withholding Certificate Forms Docs 2025, Income with the paycheck calculator.